child tax credit 2022 income limit

According to the IRS website working families will be eligible for the whole child tax credit if. The maximum credit for taxpayers with no.

What Families Need To Know About The Ctc In 2022 Clasp

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

. Threshold for those entitled to Child Tax Credit only. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year.

It will not be reduced. That said the age requirements also changed from 17 to 18. Child Tax Credit 2022 Income Limit.

Its combined with a dependents calculator so you can also add other dependents in your household. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to. The first one applies to the extra credit amount added to.

Previously you were not able to get this credit for your child if they were 17. Child tax credit is gradually being replaced by Universal Credit so not everyone will be able to claim it. The child tax credit is a credit that can reduce your Federal tax bill by up to 3600 for every qualifying child.

This is up from 16480 in 2021-22. To reconcile advance payments on your 2021 return. For 2022 the tax credit returns to its previous form.

Enter your information on Schedule 8812 Form. Withdrawal threshold rate 41. 6 to 17 years of age.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. Federal income tax return during the 2022 tax filing season. According to the irs those eligible for payments include an individual who does not turn 18 before january 1 2022.

As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only going to families that earned enough income to owe taxes. The good news is. If your adjusted family net income AFNI is under 32028 you get the maximum payment for each child.

Child Tax Credit Calculator for 2021 2022. The 500 nonrefundable Credit for Other Dependents amount has not changed. 3000 for children ages 6 through 17 at the end of 2021.

If you earn more than this the amount of child tax credit you get reduces. Get your advance payments total and number of qualifying children in your online account. Your modified adjusted gross income MAGI also needs to be within certain income limits.

The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. Will be able to receive the full amount of Child Tax Credit they are eligible for by filing a 2021 US. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

They earn 150000 or less per year for a married couple. Tax Changes and Key Amounts for the 2022 Tax Year. The child tax credit isnt going away.

For children under 6 the CTC is 3600 with 300 optional monthly advanced payments. The income limit is 75000 if youre filing single and under 150000 if youre married filing jointly. Under 6 years of age.

You must have at least 2500 of earned income during the year in order to claim the child tax credit. Child tax credit income limits. 2022 to 2023 2021 to 2022 2020 to 2021.

Thats because the child tax credit is dropping to 2000 for the year. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. The child tax credit calculator will show you exactly how much you can claim this year.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return. 3600 for children ages 5 and under at the end of 2021.

Taxpayers with qualifying childrendependent between the ages of 6 and 18 get 3000. 75000 if you are a single filer or are married and filing a separate return. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year.

The maximum credit you can receive phases out once your income reaches 400000 if youre married filing jointly or 200000 if you use any. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. What are the Maximum Income Limits for the Child Tax Credit 2022.

In the meantime the expanded child tax credit and advance monthly payments system have expired. That means that when parents claim the tax credit on their returns next year the benefit will be reduced to the previous maximum of 2100. Starting in 2022 the earned income tax credit is.

But without intervention from Congress the program will instead revert back to its original form in 2022 which is. The maximum Earned Income Tax Credit is 560 for no children 3733 for one child 6164 for two children and 6935 for three or more children. IRS Tax Tip 2022-33 March 2 2022.

For a child born in March 2022 you will be eligible to receive the CCB in April 2022 or the month following the month you become eligible. The child tax credit has been increased from 2000 to 3000 or 36000 depending on the age of the qualifying child.

Irs Starts Accepting Income Tax Returns Monday Here Are The Letters You Need To File Yours Wpxi In 2022 Income Tax Return Irs Taxes Irs Tax Forms

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Irs Provides Fsa And Hsa Tax Break For 23andme As A Medical Expense Tax Pro Today Http Back Ly U2ewj Medical Estimated Tax Payments Tax Payment Nanny Tax

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Here S Who Qualifies For The New 3 000 Child Tax Credit

Pin By Susan Bucki On Home Health Tips In 2022 Adjusted Gross Income Tax Credits Income Tax Return

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

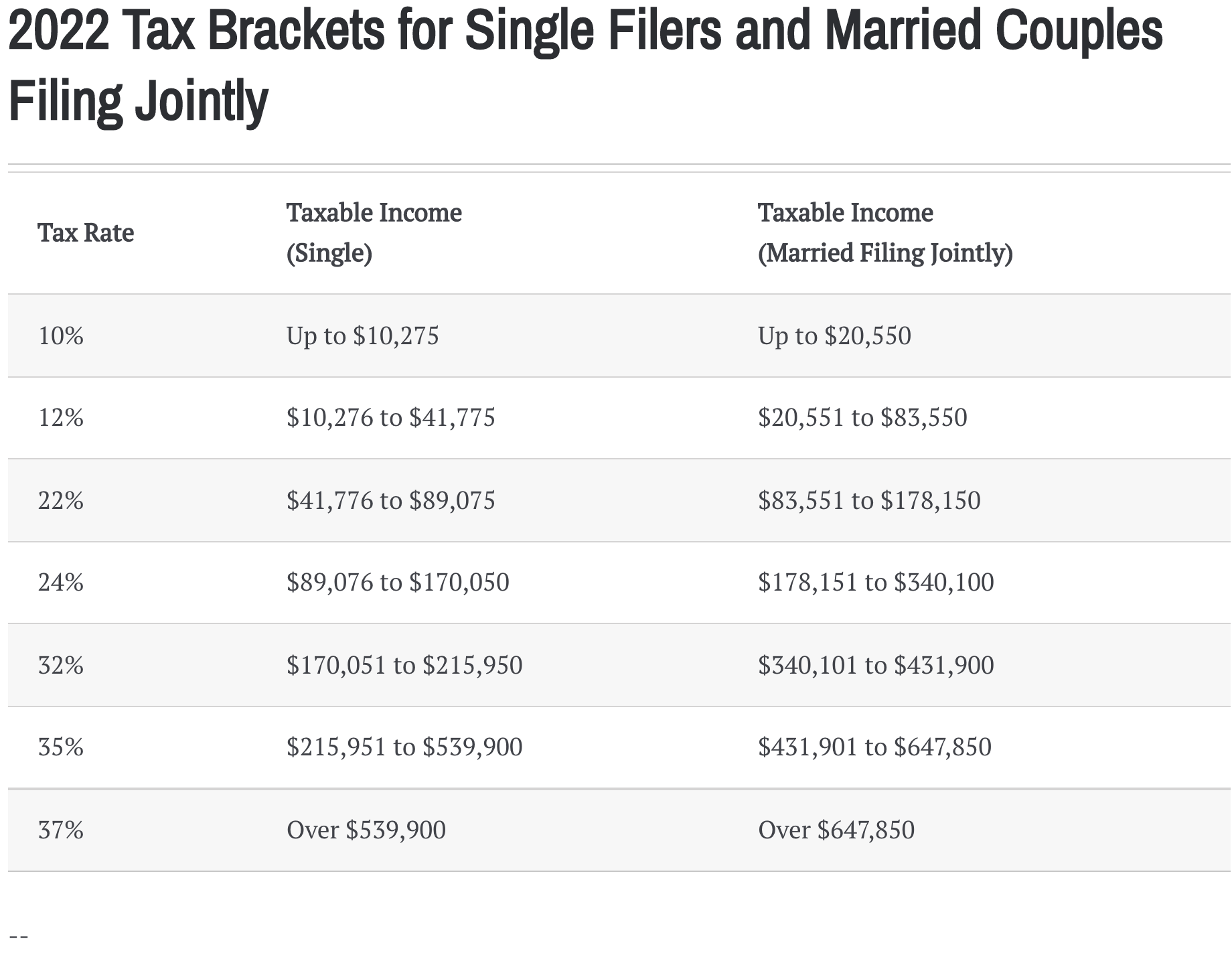

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

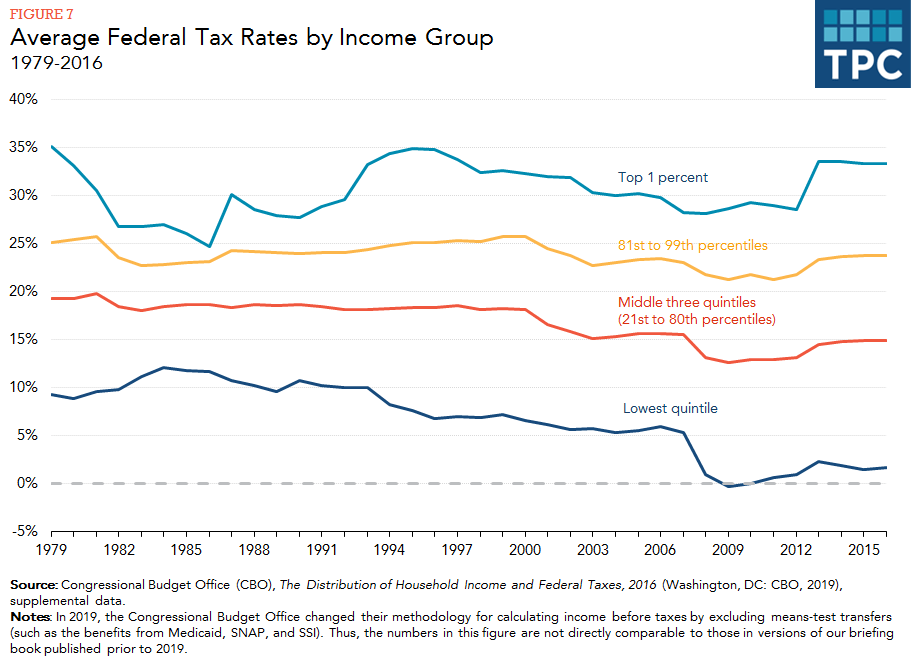

How Do Taxes Affect Income Inequality Tax Policy Center

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Who Has To File Income Tax Return Mandatorily You May Be Liable To File Your Income Tax Return Itr This Time Even Income Tax Return Filing Taxes Income Tax

Kentucky Housing Mcc Khc Mortgage Credit Certificate Mortgage Refinance Mortgage Kentucky

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contracto Federal Income Tax Tax Income Tax

Child Tax Credit Definition Taxedu Tax Foundation

Income Tax Brackets For 2022 Are Set

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

Understand Capital Gains Tax On Home Sale What You Need To Know In 2022 Capital Gains Tax Capital Gain Filing Taxes